Raising money for your startup doesn’t have to be an impenetrable mystery, like whether your fridge light stays on when you shut the door. Every week, I meet people who still haven’t figured it out. In this article, I’ve shared some common mistakes I stop people from making.

The fridge light turns off. Next topic, fundraising.

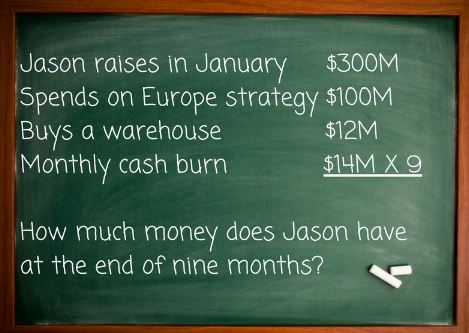

- Too little, too late: In an earlier article, I mentioned that startups should raise more money than they need, or else risk becoming a #BurnRateZombie. We are part of a volatile ecosystem. It’s good to be prepared, especially when you’re starting out.

What most entrepreneurs also seem to forget is that raising funds takes time.

Even if you strike a deal, it could be months before the money is transferred into your account. Don’t ever stop raising funds. Continue to network and interact with the right people, even if you don’t need the money right away.

Most importantly, be mindful of your burn rate and runway. It’s easy to get so consumed in growing the business that you lose track of critical financial numbers. If needed, work with companies that offer financial services to keep you on top of your numbers. There are plenty of startup accounting services in the market to do this work. The important thing is to watch your runway like a hawk so you can have your investor outreach strategy ready when you need it.

2. Too much, too soon: When it comes to fundraising, too often, people focus on the how, and not enough on the ‘how much’ and ‘when’.

We’ve heard horror stories of promising companies that get massive funding early in their life cycle only to die a quick and humiliating death. Color started off as a photo-sharing app that raised a whopping $41 million in 2011. This was before it had added a single user.

What happened?

It shut down months later in September 2012. The team was acqui-hired by Apple, but

there was so much negative publicity around the app that Apple never even bothered with an announcement! Experts proclaimed that the product did not resonate with the customers. In other words, a bad product-market fit.

FYI, Instagram had raised a $500,000 seed round.

3. Selling yourself too low: Another drawback of raising too much too early in is the high probability of a low valuation. You’ve given away some equity as well, which would mean you no longer have complete control over your new business. You now have a lot of money, an iffy product, no real proof of concept, and someone you are answerable to. How would that work for you?

Remember this: A startup operates in two phases — the build stage and the growth stage. Funds fuel growth.

During the build stage, it’s important to stay lean, and not be controlled by VC money because it can often complicate things.

The problem is, when entrepreneurs raise millions, there’s pressure on them to spend it. VCs did not give them the money to accrue the savings interest. However, until the founders fully understand the market and how their solution fits into it, they can’t spend it in the right direction.

4. More money, more mistakes: When you have limited resources, you are forced to look deeper and make tough choices. It pushes you to negotiate harder on your office lease, or perhaps take a more frugal space. It teaches you how to stretch a dime to a dollar, and make each dollar work for you the right way. It will force you to keep salaries palatable in an inflated market, and will constantly push you to take decisions that bring you closer to your revenue model. These are hard decisions, and these hard decisions make for a solid foundation.

5. Don’t spray and pray: Don’t make the mistake of reaching out to every investor you’ve heard of. Do your homework. I’ve heard of startups at seed stage pitch to investors who don’t invest in companies that size or in that industry, only to be disappointed in the end. Save yourself the heartbreak and look for funding in the right places. Know your audience and speak their language. Are you trying to pitch a food delivery service to Mark Cuban? Chances are he will decline.

6. Consult an expert: Talk about being penny-wise and pound foolish. Some entrepreneurs decide not to get legal and financial help when signing term sheets to save a few thousands. How does that end? With a raw deal that could cost you a lot more than what you were trying to save.

Understanding the right valuation, pre- and post-money, in case of multiple funding rounds and what terms are actually good for your company requires specialized knowledge. Even before you speak to an investor, work with a good financial advisor to help understand what you need and deep dive into the numbers.

Got a question? Leave a comment.