-

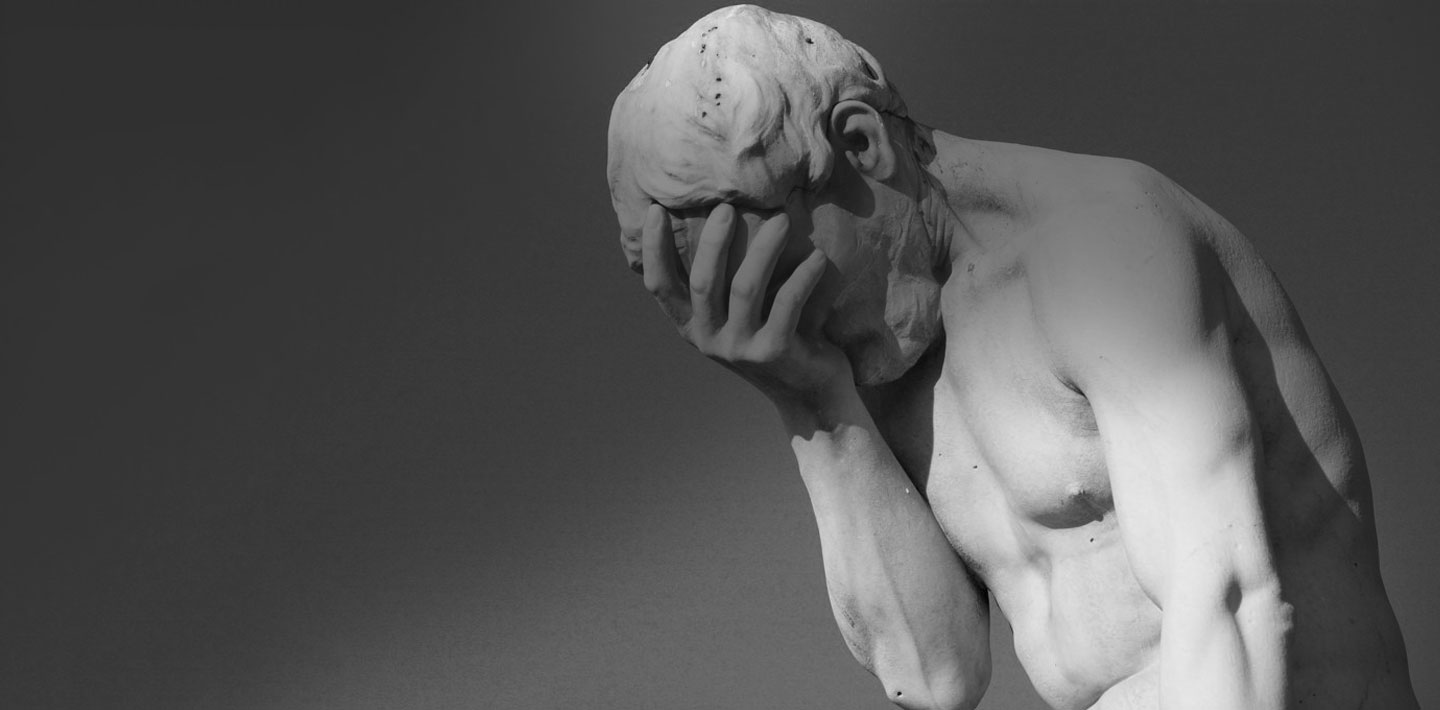

Because you have better things

to think about, than...

You did not quit your cushy job to record transactions in books or prepare board reports.

We know you are smart enough to do this on your own, but you already know that the garbage you put into the accounting books on the last Friday of the quarter, is the garbage that comes back in your board reports.

Accounting needs to be someone's #1 priority, but should that someone really be you?

Your wish for the boring-but-reliable accountant has been granted. This is all we do, and we are good at it. But don't call us to your office parties, we are not exactly party animals. You focus on growing your company, adding users, building the right team, and fall in love again with what you do.

Recording and classifying daily transactions, reconciling bank accounts, managing account receivables and payables, cash application against invoices, payroll, and maintaining GAAP-compliant books. We test your transaction classification against thousands of similar transactions to get the classification correct. No garbage in!

Financial models that even engineers can use! Custom inputs that force you to think through your company construction over the next couple years. Forecast and budget vs. actual charts that you can plop straight into your Board presentation. Want to track your fancy SaaS metrics? We got your covered!

Executive-level financial leadership, including preparing for and attending Board meetings, creating financial forecasts, tracking Key Performance Indicators, providing a eagle eye view to the senior management of what is important to focus on.

When was the last time someone gave you actionable feedback on your pitch? Did someone translate VC English into normal English that you could understand? How much money to raise? At what valuation? How to get that valuation? Which VC to talk to? How to get to them?

Not every start-up can afford a CFO, but the investment structuring, equity / option allocation, spending, and human resource decisions you make in the early stages of your business can make or break you.

*It is a serious commitment

Sandeep brings ~30 years of experience spanning finance, investment analysis, strategic planning, and technology, including the last decade and a half of leadership experience (as CFO) in fundraising (~$2B aggregate raised) and strategic and tactical financial management. He has worked with hundreds of start ups from pre-revenue to multi-million dollar revenue. Sandeep has a Master's in Computer Science from Syracuse University and an MBA in Finance from the Haas School of Business at UC Berkeley.

Sudhir has nearly 20 years of experience in the Finance, Tax and Accounting fields. Sudhir brings particular strengths to the area of informal business consulting, working closely with business owners and managers to analyze their operations and devising practical solutions for their needs. At Infosys Technologies, he was responsible for Finance & Accounts related activities (including Capital Budgeting, Treasury, & Procurement), policy making, infrastructure, facilities, and country penetration.

Raghav has nearly 15 years of experience in the Finance, Tax and Accounting fields. He is a Associate Chartered Accountant (ACA) from Institute of Chartered Accountants of India (ICAI) and Diploma in International Financial Reporting Standards (IFRS) from A.C.C.A, UK. He has expertise in handling complex areas of USGAAP & IFRS including first-time adoption, new revenue recognition model, leases, mergers and acquisitions accounting, complex consolidations and Purchase Price Allocations.

With a proven track record as the CFO of a $2.0 billion investment fund and extensive expertise in audit, M&A, and international finance, Carlos provides strategic financial guidance to startups at various stages, helping them establish solid financial foundations, enhance financial governance, secure funding, and expand globally. He holds an MBA from IESE Business School.

Chuck is an experienced business leader with over 20 years of experience in establishing firm foundations for success through scalable business processes, budget controls and monitoring, cash flow management and the promotion of sales growth. Chuck has been a CEO, CFO, Finance and Operations Manager and played General Management Roles in the Telecommunications and Technology markets. Chuck is a CPA and has an MBA from Tulane University.

Lucy brings on board more than 17 years of finance and management experience from tenures at world-renowned organizations such as the London Stock Exchange. Lucy was CFO at Trovix (sold to Monster Worldwide), Piczo (sold to Stardoll), Lexit Financial Group and First Tuesday. Lucy spent eight years at PricewaterhouseCoopers LLP and holds a B.S. in Commerce from Santa Clara University and is a CPA.

Raised in Equity+Debt by our clients

Bookkeeping entries

Businesses modeled

For careers and job openings, please reach out to careers@mystartupcfo.com

For sales inquiries, please email us at info@mystartupcfo.com, or fill out the form below!

Copyright © 2023 myStartUpCFO. All rights reserved.