India’s Taxi Wars will make a great movie one day. The good guys, however, don’t always win.

Sometimes they die before the movie climaxes. Today, the leaders in India’s taxi wars are Uber and Ola. It wasn’t always so. There was another, a more scrappy competitor in the early days.

It’s 2015, Uber had been blocked out of China, and had their eyes on India, the next largest market. There were already many copycat businesses in India that were preparing for Uber’s arrival. The main two were Ola and TaxiForSure.

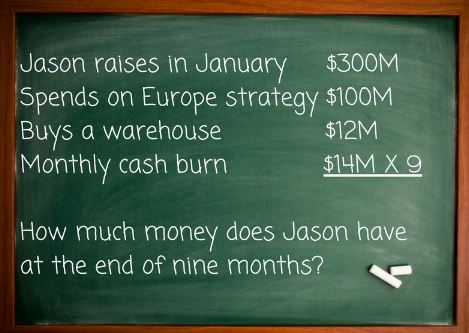

In anticipation of Uber going full-throttle, both Indian companies started to burn money on subsidized trips and city expansion. TaxiForSure was a well-run upstart. They had a disciplined management team, raised a round of $30M, and had mastered the art of operation and expansion into India’s chaotic market. In three months, they had already expanded to 47 cities. They were subsidizing each trip for approx $3 each and were clocking 8,000 trips a day.

Both the Indian companies needed to raise money fast. Word on the street has it that TaxiForSure considered themselves a better-run company, and was asking for a higher valuation, and so held out longer for the right fundraise. Ola, in the meantime, raised $200M from SoftBank at a valuation of $2.5B. Now they had the cash to burn. TaxiForSure was down to four months’ burn but continued to burn money regardless. At this stage, they should have taken the help of companies providing financial services who could have helped them optimize their burn rate.

On Jan 12, 2015, Raghu, the founder of TaxiForSure, boarded the flight to San Francisco. He was set to meet 20 VCs on that trip. But as he was flying over the Arctic, his world turned upside down. An Uber driver had raped his passenger in India that night, making Uber Public Enemy #1 in a nation housing one-sixth of the world’s population.

Every VC Raghu met had only one question: With the Uber incident, what’s the fate of the unregulated radio taxis in your country? The cloud of uncertainty rained on Raghu’s Sand Hill Road parade. It questioned the ethics and business policies of the heretofore unregulated $7B radio taxi business in India, and no investor wanted to touch this with the proverbial ten-foot pole right now. With no cash and continuing to burn, he was more than dead. He’d become a burn rate zombie.

Fast forward barely two months Raghu sold all of TaxiForSure to Ola for $200 M, which was the amount he was hoping to raise, at many times that valuation.

Knowing the importance of fundraising and a manageable burn rate is startup 101, and yet, why do so many founders fail?

‘It will never happen to me’

I have worked with hundreds of founders, and all of them assure me (and themselves!) that ‘it will never happen to me’. Yes, you understand your product, market, and product-market fit. But do you understand all the aspects of your cash burn? What can you control in the short run and what you can’t? Is employee salary a variable cost or a fixed cost? If you are unsure about the answer to these questions, you need the help of companies that offer financial services immediately.

90%+ of founders will shut down their company eventually. 100% of these closures will be because the company ran out of money.

Just one tip.

You are spending more than you think you are. And fundraising really isn’t going to happen as quickly as you’re planning it would.

What can you do?

In my experience of more than 25 years, I have observed a few bright red flags that warn of the winter to come.

Look out for them in my next post.